Television usage ticked up to start 2023, thanks not only to some big-ticket live sports but also new broadcast dramas and a steadily growing supply of new streaming content.

Overall usage rose 1.3% in January from December, according to “The Gauge” from Nielsen, the ratings firm’s monthly overall look at TV delivery platforms.

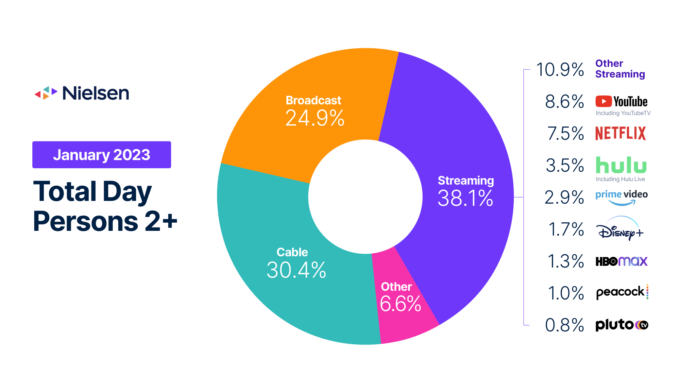

Streaming kept its share as the top use of a television, an honor it claimed starting last summer – holding at 38.1%, the same as December. Cable had the second-biggest share but ticked down again (to 30.4% from 30.9% of TV time), while Broadcast rose to 24.9% from 24.7%, and “Other” (heavily videogaming, but also including such uses as viewing video discs) rose again, to 6.6% from 6.3%.

Broadcast usage rose 2.1% overall, Nielsen noted, driven by a 29% month-over-month increase in viewing of dramas, and a 55% jump in sports, thanks in near total part to the viewer behemoth that is the NFL playoffs (which swept the top 10 viewed programs for January). Cable saw a similar sports bump get wiped out by a 19% drop in cable movie viewing as America returned to work after the holidays.

Streaming usage ticked up 1.2%, though a couple of individual streamers changed share a bit as the gradual fragmentation of the space continued. YouTube/YouTube TV (NASDAQ:GOOG) (GOOGL) continued to hold top share, though it dipped to 8.6% overall share from the prior month’s 8.7%. Netflix (NASDAQ:NFLX) held steady at 7.5% share.

The next couple of rivals made gains, however: Hulu/Hulu Live (NYSE:DIS) (CMCSA) gained share to 3.5% from 3.4%, and Amazon Prime Video (NASDAQ:AMZN) rose to 2.9% from 2.7%.

That came in part at the expense of Disney+ (DIS), which dipped to 1.7% share from 1.9%. HBO Max (WBD) also lost ground, to 1.3% from 1.4%. Peacock (CMCSA) held steady at 1%, and Pluto TV (PARA) (PARAA) held serve at 0.8%.

“Other streaming” (including smaller services like Crackle (CSSE) as well as linear streamers like Spectrum (CHTR), DirecTV and Sling TV (DISH)) rebounded with a gain, to 10.9% overall share.

TV usage ticks up as broadcast gains, though streaming is still tops in share

Recent Comments

on 2023 NFL All-Rookie Team: CBS Sports draft expert, former GM unveil league’s best first-year players

on Devout athletes find strength in their faith. But practicing it and elite sports can pose hurdles

on The Rev. Al Sharpton to lead protest after Florida governor’s ban of African American studies course

on After UFC Fallout, Conor McGregor Offers a Valuable Piece of Advice to Free Agent Francis Ngannou

on CONCEPT ART: New Details Revealed for Disney Cruise Line Lookout Cay at Lighthouse Point Destination

on Saipan, placid island setting for Assange’s last battle, is briefly mobbed – and bemused by the fuss

on CONCEPT ART: New Details Revealed for Disney Cruise Line Lookout Cay at Lighthouse Point Destination

on David and Victoria Beckham so ‘Charmed’ by Tom Cruise They Have His Photos on Display at Their Home

on Iowa State starting RB Jirehl Brock among latest college football players charged in gambling probe

on Biden to tout bill’s prescription drug prices, energy provisions in pitch to Americans, aide says

on Iowa State starting RB Jirehl Brock among latest college football players charged in gambling probe

on The Rev. Al Sharpton to lead protest after Florida governor’s ban of African American studies course

on Sports World Hails ‘Superwoman’ Lindsey Vonn for Her Grand Comeback Despite Career-Changing Injury

on San Mateo County Community College District sues five companies over role in ‘pay to play’ scandal

on Saipan, placid island setting for Assange’s last battle, is briefly mobbed – and bemused by the fuss

on ‘Pokémon Scarlet’ and ‘Violet’ Fan Theories Suggest Legendary Time Travel, Alternate Dimension Plot

on Joe Manchin and Tommy Tuberville introduce bill on name, image and likeness rules for college sports

on Inside the Michael Jordan ‘Air’ movie, plus why NFL, others are buying into the sports film industry

on If you’re a frequent traveler, these wrap tops from Aday will revolutionize your on-the-go wardrobe

on How Does Jack Nicklaus Travel? Exploring the Private Jets Owned by the ‘Golden Bear’ Over the Years

on Hollywood Reporter: Tom Cruise negotiated with movie studios over AI before the actors strike began

on Ford Blue Cruise: US regulators investigate fatal crashes involving hands-free driving technology

on Dozens of boats cruise the Seine in a rehearsal for the Paris Olympics’ opening ceremony on July 26

on Devout athletes find strength in their faith. But practicing it and elite sports can pose hurdles

on Despite strong Lunar New Year holiday data, consumer spending in China isn’t roaring back just yet

on David and Victoria Beckham so ‘Charmed’ by Tom Cruise They Have His Photos on Display at Their Home

on CONCEPT ART: New Details Revealed for Disney Cruise Line Lookout Cay at Lighthouse Point Destination

on CBS Sports announces Matt Ryan will join NFL studio show. Longtime analysts Simms and Esiason depart

on Boston College vs. Army live stream, how to watch online, CBS Sports Network channel finder, odds

on Boise State vs. Air Force live stream, odds, channel, prediction, how to watch on CBS Sports Network

on Biden to tout bill’s prescription drug prices, energy provisions in pitch to Americans, aide says

on After UFC Fallout, Conor McGregor Offers a Valuable Piece of Advice to Free Agent Francis Ngannou

on 2024 Super Bowl: CBS Sports Network and CBS Sports HQ to combine for 115 hours of weeklong coverage

on ‘Best Intention’: Chris Kirk Has Absolute Trust in Jay Monahan and PGA Tour’s Widely Debated Model

on 2023 NFL All-Rookie Team: CBS Sports draft expert, former GM unveil league’s best first-year players

on “Completely Knocked Me Out”: Rob Lowe Recalls Boxing Match With Tom Cruise On 1983 Brat Pack Classic

on CONCEPT ART: New Details Revealed for Disney Cruise Line Lookout Cay at Lighthouse Point Destination

on “Completely Knocked Me Out”: Rob Lowe Recalls Boxing Match With Tom Cruise On 1983 Brat Pack Classic

on CBS Sports announces Matt Ryan will join NFL studio show. Longtime analysts Simms and Esiason depart

on Carlos Sainz’s Soccer Fanboy Emerges as Spaniard Shares Defining Moment With This Real Madrid Legend

on Biden: ‘At this point I’m not’ planning to visit East Palestine, Ohio, after toxic train derailment

on ‘Best Intention’: Chris Kirk Has Absolute Trust in Jay Monahan and PGA Tour’s Widely Debated Model

on Ahead of big sports weekend, dispute with Disney leaves millions of cable subscribers in the dark

on A heavy wave of Russian missile attacks pounds areas across Ukraine, killing at least 4 civilians

on 2024 Super Bowl: CBS Sports Network and CBS Sports HQ to combine for 115 hours of weeklong coverage

on 2023 NFL All-Rookie Team: CBS Sports draft expert, former GM unveil league’s best first-year players

on Army vs. Coastal Carolina live stream, how to watch online, CBS Sports Network channel finder, odds

on AL Rookie of the Year Julio Rodriguez Spreads Joy and Sportsmanship to the Youth of Loma de Cabrera

on After UFC Fallout, Conor McGregor Offers a Valuable Piece of Advice to Free Agent Francis Ngannou

on Dubai International Airport sees 41.6 million passengers in first half of year, more than in 2019

on Devout athletes find strength in their faith. But practicing it and elite sports can pose hurdles

on Despite strong Lunar New Year holiday data, consumer spending in China isn’t roaring back just yet

on Dave Portnoy: Taylor Swift’s security should ‘drag Kim Kardashian to jail’ if she attends Eras Tour

on CONCEPT ART: New Details Revealed for Disney Cruise Line Lookout Cay at Lighthouse Point Destination

on “Completely Knocked Me Out”: Rob Lowe Recalls Boxing Match With Tom Cruise On 1983 Brat Pack Classic

on CBS Sports, Serie A announce new TV rights deal; Paramount+ to air over 400 Italian soccer matches

on Cam Newton’s Violent Public Incident Draws Hilarious Reaction From 3x All-Star: “Where Do I Sign Up

on Boston College vs. Army live stream, how to watch online, CBS Sports Network channel finder, odds

on Angel Reese Launches Foundation Dedicated To Empowering Women Through Sports & Financial Literacy

on A weaker dollar, skyrocketing prices and ‘record’ visitor numbers: Good luck in Europe this summer